Welcome to this week’s edition of Cape May Wealth Weekly. If you’re new here, subscribe to ensure you receive my next piece in your inbox. If you want to read more of my posts, check out my archive!

Back in my Goldman days, my boss used to read a magazine called Private Wealth. They had three fittingly named sections in each edition: One, how to earn it - meaning entrepreneurial success stories. Two, how to invest it - outlining topics such as impact investing or real estate. And last but not least, how to live it - or how he liked to call it, how to spend it: Stories about lifestyle purchases only the ultra-rich would really think about, ranging from yachts to private yets to high-end watches.

How to spend it is perhaps the most important question to us and our clients at Cape May. But unlike the Elon Musks or other billionaires of the world, to whom spending money on yachts and art might come as easy as I buy a coffee at LAP, the affluent entrepreneurs we work with are usually not quite in those echelons (yet). Such individuals, typically with net worths between 2 and 25 million euros, know that they’ve built life-changing wealth - but worry how much they can actually spend in order to leave some money to their children, or at the very least, not run out of money in their lifetime.

So today, let’s ask ourselves those questions related to how to spend your hard-earned money - especially how much you can spend, and how much you should spend.

How much can you spend on lifestyle expenses?

For me and my colleagues at Cape May, lifestyle expenses are not an afterthought, but one of the key figures that we ask our clients about. After all, we want to get a holistic picture of a client’s financial situation - and since almost all clients (sometimes only if probed) see long-term financial stability in their lifestyle as their primary Investment Objective, we wouldn’t be doing our work not asking for those figures. And rightfully so, asking this question might lead to a counter-question of their own: Can they spend as much money as they are spending? That is a more nuanced question.

First of all, their personal cashflow profile. How much money is coming in (i.e. a salary from their business, consulting income, or other ongoing cashflow like rental income), as opposed to how much money is going out (i.e. the aforementioned lifestyle expenses). And leaving everything aside, even if a client is spending substantial sums, that might not actually matter if their ongoing income, especially income separate from their investment portfolio, (mostly) covers their lifestyle expenses. Take for example not a post-exit founder, but a top-level executive, a partner at an investment firm, or an athlete (all types of clients that we also work with at Cape May) - while they might not yet have millions of euros sitting in their bank account, they typically have very high ongoing income in the mid- to high-six figure range. Is the absolute figure high? Definitely - but if their ongoing cash flow profile sustains it, meaning they are not just scraping by but still seeing substantial ‘excess cash flow’ to invest, we won’t be the advisor to angrily wag their finger and tell them how irresponsible they are.

But of course they should still be careful. Take, for example, your typical successful athlete: While they might make six or even figures today, chances are that they won’t sustain this degree of income forever. And many newspaper stories of athletes and entertainers alike show that nothing is more fatal than if that income stream dries up without the person preparing themselves for it - whether that’s through cutting back their lifestyle expenses (very tough from my experience) or by building the necessary financial buffer.

Which brings us to our second consideration: Whether their investable assets support their level of spending. This is more of a question for a post-exit founder who sold their business for 2 to 25 million euros and now is wondering how to spend their newfound money. While tech entrepreneurs often begin their investment journey from an angle of maximizing returns through high-risk, high-reward investments such as private equity or venture capital, a thorough discussion with me and my colleagues often leads to the realization that even more important than high returns do they want to have the certainty of never having to work again (the aforementioned ‘long-term financial stability’).

Practically, we try to answer their question of much they can spend through the correct sizing of the liquid part of the Market Bucket in the Aspirational Investor Framework. We consider a client’s ongoing spend (i.e. 10.000€ a month) and their total net worth (i.e. 10M€), and then think about either how much of their net worth needs to be invested at a given, realistic return to maintain that spending. Alternatively, we analyze much of their capital could be invested in such a portfolio after deducting their other existing assets and cashflow requirements (like buying a private residence, start-up investments, or ‘aspirational’ purchases like a nice car) and then assess whether we and the client deem the resulting return achievable.

We find this approach of ‘flipping the script’ of not asking the client how much they want to make, and/or which risk level they want to achieve (as my colleague Markus would like to quote our former banking colleagues: “are you feeling conservative, moderate, or aggressive today? With or without hedge funds?”), but rather than finding what return they need, to be the much better approach compared to our peers. More than one very return-oriented investor ‘saw the light’ and fell in love with the concept of constructing their liquid asset portfolio not for maximum return and risk but rather minimum risk given their required return - giving them the long-sought certainty that they can actually invest the remaining capital (the “Aspirational Bucket”) in high-risk, high-reward opportunities without worrying whether they’ll run out of money. Even if all investments go poorly.

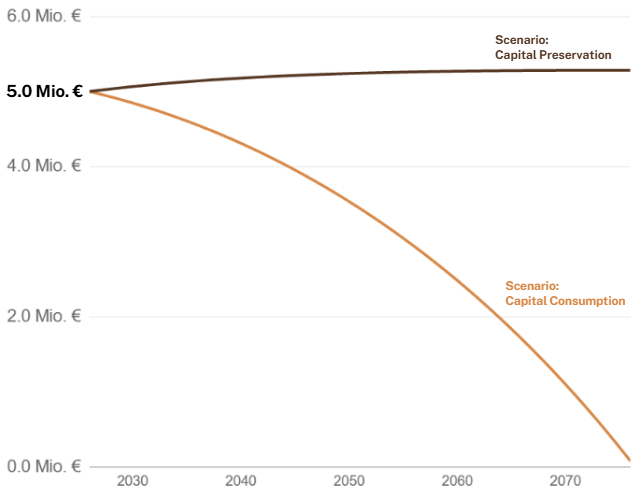

Let’s make this a bit more tangible. Let’s take the aforementioned figures and the second approach, i.e. the required return given a certain amount of capital (in this case, 5.0M€) and a desired lifestyle spend (10.000€ a month). Our resulting analysis for a client, taking into account additional considerations like inflation and tax, would look something like the following:

Source. Cape May Wealth Advisors. For informational and illustrative purposes only, based on the information provided. There is no guarantee that the stated objectives will be achieved. The stated return values are based on a mathematical calculation—there is no guarantee that capital preservation will be achieved even with a higher average return. Cape May Wealth Advisors GmbH does not provide legal or tax advice; for an accurate assessment of your individual situation, consult your lawyer or tax advisor.

In our analysis, we typically consider (at least) two different scenarios - one, which return is required to fulfill a client’s income requirements and still maintain their portfolio (the upper line, or as we like to call it, “capital preservation”), and two, which return is required to ‘end at zero’ (or as some say, die with zero) while still fulfilling their income requirement (“capital consumption”). Using the aforementioned assumptions (5.0M€ assets, 10K€ a month, 50-year timeframe as well as certain assumptions around tax and inflation), we’d require 6,7% annual return to maintain our portfolio, and a 5,6% annual return to consume the portfolio, i.e. end at 0.

Of course, such an analysis should always be always be taken with a grain of salt. We don’t know what’s going to happen tomorrow, yet alone in 50 years. But in our experience, such analysis gives clients an indication whether they are on track, i.e. does their plan feel achievable, or whether they need to make adjustments.

So with that in mind, let’s look at our question from another angle: How much should you spend?

How much should you spend on lifestyle expenses?

We can answer this question in two ways - in a rational way, and in a philosophical, personal way.

First, the rational view - let’s assume those figures, i.e. 5.0M€ assets, 10K€ a month, 50-year timeframe, describe your situation. The output are the aforementioned figures, i.e. a 6,7% annual required return for capital preservation, or a 5,6% required return for capital consumption. Is that good? Is it bad? Once again, there’s many nuances:

From a purely financial standpoint, we think that a 5,6-6,7% annual return is not low, but achievable (also in light of the track record of our strategies). However, it is not a low return that can be achievable purely by safer investments such as bonds or even the interest on your bank account. But that’s our personal assessment - some clients (and fellow wealth advisors) would find it high, other would find it far below the return they want to achieve.

There’s no formal assessment of whether the 10K€ figure is justified. Few clients ask us how much we think they should spend and rather want to see if our calculation justifies their current level of spending. 10K€ a month might be a reasonable figure, but it might equally be unreasonable if half of it is spend in imprudent ways. As mentioned before, while we mean not to judge how our clients spend their money, we always try to see if we can save them money - for example by cutting unjustified expenses or negotiating for cheaper rates (like for an insurance).

It doesn’t take into account other assets you might have. We typically conduct this calculation for a client’s ‘Market Bucket’. While that is often the biggest part of their total assets, it is often not the only part - they might for example also have ‘Safety Bucket’ assets like a private residence, or ‘Aspirational Bucket’ assets like crypto or a VC portfolio. If your 5.0M€ get to the result above, but you have the same amount invested in a well-diversified venture portfolio, you likely don’t have to worry. But if the 5.5M€ is all you have, there is residual risk that a market crash or a change in spending might tilt your required return into a less sustainable territory.

It is subject to secondary assumptions. Take for example the 50-year timeframe: For a 30-year old entrepreneur interested in longevity, that timeframe might be too low, underestimating the required return, while for a 50-year old entrepreneur, that might actually overstate it. There’s also questions around taxation or inflation that might differ by person and are hard, if not impossible, to predict.

As you can imagine, we as financial advisors tend to lean on a more careful side - we want to make sure that our clients (at least based on the model) have a very high probability of not running out of money, typically through a combination of an achievable return and redundancies such as a buffer in their lifestyle spend or other assets. But in the end, it remains a model calculation, driven by the underlying assumptions. Don’t generalize, but conduct your own, and review it on a regular basis. As we do with our clients.

Second, the philosophical, personal view - which asks the question of what the individual investor wants to achieve. If you want to maximize your wealth, i.e. to pass on to your children or to have more money for charity, perhaps you’d aim for a higher return even if you don’t need it for your lifestyle. If you want to ‘die with zero’, you might want to optimize somewhat precisely for your required return, but spend more aggressively than your peers. Or perhaps you just don’t want to deal with your portfolio at all and perhaps take less risk than you could take. Even if your situation fit the aforementioned assumptions perfectly, it might or might not fit your outcome and preferences.

No two clients are the same in their answer: Some simply haven’t found their answer to that question yet, opting for a balanced approach. Others set out with another approach (such as ‘die with zero’) and soon realize that perhaps they want to pass on some of their wealth to their children after all. While clients do compare themselves with one another, in the end there’s no right or wrong - but we do our best to help our clients find out what is right for them.

If you want to know your own sustainable spending ‘number’, and build a system that gives you peace of mind for your future, reach out to Cape May. We’ll help you map your spending plan, test your assumptions, and institutionalize your wealth management, so you can focus on what matters most - whether that is your new venture, a passion project, or your family.

Proper lifestyle spend - in practice

As I highlighted before, a lot of those calculations, no matter how well-built and personalized they are, remain calculations and models. Even the most beautiful 50-year graph (like the one below) don’t matter if your plan falls apart in the first months. To make sure you succeed, you need to commit for the long term, regularly review your assumptions, and be critical of yourself and your ‘fallacies’ as an investor and individual.

So let us conclude today’s article with a real example. A long-time client of ours came to us a few years ago, asking us to help him find high-risk, high-reward investment opportunities in private equity and venture capital. Standing true to our approach of diligent financial planning, we built a detailed cashflow plan for them, taking into account different levels (i.e. personal level and holding company level) and different types of spend (i.e. investment spend like new VC investments, and personal spend like cost of living and a mortgage). To their surprise, my resulting recommendation based on this cashflow plan was not a private equity fund, but rather something akin to personal balance sheet restructuring - in our view, they were at serious risk of running out of money.

With that began a multi-year process of helping him ‘right the ship’. We built various scenarios outlining different paths like the one above, for example assessing how long their ‘Market Bucket’ would last taking into account a realistic return, or calculating what return would be needed to provide long-term financial stability. The latter came out to double-digit returns that would require taking a level of risk that was simply not prudent - so we instead focused on other measures, such as helping them bring down their spend or creating other sources of income (such as consulting), but also selectively liquidating assets in the ‘Aspirational Bucket’ to fill up his ‘Market Bucket’.

Today, through a combination of stable market returns, favorable events in their venture portfolio, and discipline on their end - also supported by our services and a regular update and review of his financial plan - has finally put them into calmer waters again. When we speak, I can sense that they are much less worried about their financial future, giving them the peace of mind required to tackle a new project. The work isn’t fully done yet, but I am certain that in a quarterly review in the near future, I can congratulate them on having achieved actual financial independence.

In the end, the question of how much you can spend goes far beyond finding the right number in an excel model. It is building a framework that gives you confidence that you’ve achieved financial independence - or that you are at least on the right track to achieve it. The right plan helps you stop worrying, and lets you focus on the things that are actually important to you. And in the sense of my old boss’ favorite magazine, might also leave you with a bit of ‘how to spend it’ money.

Cape May Wealth Advisors is a Berlin-based wealth management firm focused on helping affluent entrepreneurs find financial independence. If you are interested in learning more about how we can help you, reach out to us via email, and make sure to subscribe to our newsletter.